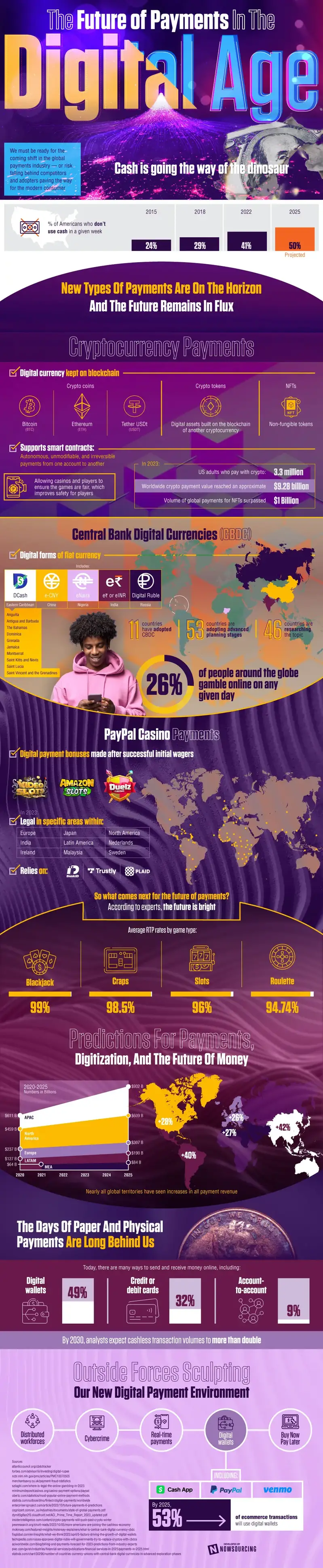

Cash is already beginning to fade into obsolescence. Gone are the days when most major transactions were paid with bills and coins. As most of our shopping shifts to taking place online, digital payments will become a requirement and not merely a technological novelty. This trend is already beginning to take place, as the number of people who do not use cash at all on a weekly basis has doubled within the last decade. Rising to take cash’s place are many new forms of virtual payment structures, such as digital wallets and cryptocurrency.

Digital wallets are already beginning to reign supreme, with 49% of cashless transactions being completed with the likes of apps such as Venmo, CashApp, and PayPal. It is predicted that by 2025, 53% of all eCommerce transitions will be completed with a digital wallet, which is a vast portion of the economy. Cryptocurrencies are also gaining traction as a popular payment method as well, with 3.3 million American adults using this technology to pay for goods and services. Popular coins such as Bitcoin and Ethereum are valued for their ability to uphold “smart contracts”, meaning the transactions are autonomous and irreversible.